Best NFC Payment Apps for Australia & India in 2025

Table of Contents

- 1. What is NFC Payment Technology?

- 2. Why Should You Use NFC Payment Apps?

- 3. Best NFC Payment Apps in Australia (2025)

- 4. Best NFC Payment Apps in India (2025)

- 5. NFC Payment Apps Comparison Table

- 6. How to Set Up NFC Payment Apps (Step-by-Step)

- 7. How Secure Are NFC Payment Apps?

- 8. The Future of NFC Payments in Australia & India

- 9. Frequently Asked Questions (FAQs)

What is NFC Payment Technology?

NFC (Near Field Communication) is a short-range wireless technology that enables two devices to communicate when placed within approximately 4 centimeters of each other. In the context of payments, NFC allows your smartphone to act as a contactless payment card, enabling fast, secure transactions with just a tap.

According to Juniper Research, the global contactless payment market is projected to reach $18.1 trillion by 2030, with a market growth of 106.9% from 2025. This exponential growth reflects the increasing consumer preference for speed, security, and convenience in digital payments.

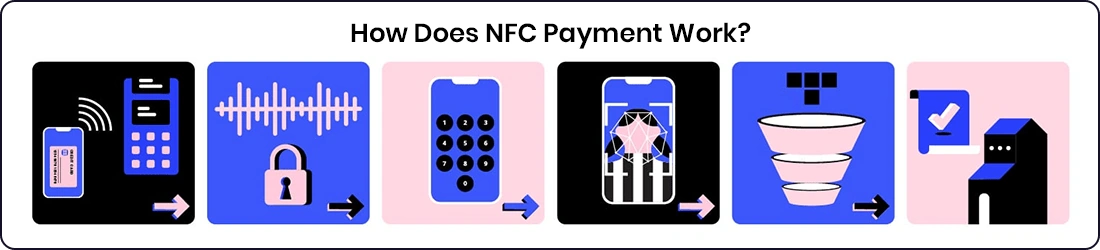

How Does NFC Payment Work?NFC payment works through a simple yet sophisticated process:

- 1. Initiation: You unlock your phone and hold it near an NFC-enabled payment terminal

- 2. Data Exchange: The NFC chip in your phone communicates with the terminal using electromagnetic induction

- 3. Tokenization: Your actual card number is replaced with a unique encrypted token

- 4. Authentication: Biometric verification (fingerprint/face) or PIN confirms the transaction

- 5. Completion: The payment is processed in under 2 seconds

Why Should You Use NFC Payment Apps?

Key Benefits of NFC Payments- 1. Enhanced Security: Tokenization ensures your actual card details are never shared with merchants. In 2025, 81% of consumers report feeling safer using contactless payment options.

- 2. Lightning-Fast Transactions: Tap-to-pay transactions are 60% faster than chip-based payments, reducing checkout time significantly.

- 3. Universal Convenience: Your smartphone replaces multiple cards, loyalty programs, and transit passes in one device.

- 4. Hygiene & Safety: No need to touch PIN pads or handle cash—especially valuable in post-pandemic consumer behavior.

- 5. Rewards & Cashback: Apps like Google Pay, PhonePe, and Paytm offer regular cashback, discounts, and loyalty rewards.

Best NFC Payment Apps in Australia (2025)

Australia has one of the world’s most developed contactless payment markets. According to the Reserve Bank of Australia, nearly 75% of all card transactions are contactless, with mobile wallets accounting for over 20% of point-of-sale payments. In 2024, Australians made more than 500 million mobile wallet payments monthly, worth over AUD 20 billion.

1. Google Pay (Google Wallet)Google Pay is the most widely used NFC payment app for Android users in Australia. It comes pre-installed on most Android devices and offers seamless integration with Australian banks.

Key Features:

- Works across all NFC-enabled Android smartphones and Wear OS smartwatches

- Tap to Pay feature with offline NFC payments via Tap to Pay

- Stores debit/credit cards, loyalty cards, boarding passes, and event tickets

- Biometric authentication (fingerprint/face unlock) for enhanced security

- Supports major Australian banks: CommBank, NAB, ANZ, Westpac, and more

Availability: Google Play Store (Free)

Best For: Android users seeking a universal, secure payment solution

2. Apple PayApple Pay dominates the iOS ecosystem in Australia, supported in over 60 countries including the US, UK, and across Europe. It offers seamless integration with iPhone, Apple Watch, iPad, and Mac.

Key Features:

- Face ID and Touch ID authentication for maximum security

- Works at millions of contactless terminals across Australia

- In-app and web payments through Safari

- Express Transit mode for public transport without unlocking

- Supports all major Australian banks and card issuers

Availability: Pre-installed on iOS devices

Best For: iPhone and Apple Watch users

3. Samsung PaySamsung Pay offers a comprehensive payment ecosystem exclusively for Samsung Galaxy devices. It stands out with Samsung Knox security framework and an excellent rewards program.

Key Features:

- Samsung Knox security protection with biometric authentication

- Works on Galaxy phones, tablets, and Galaxy Watch wearables

- Samsung Rewards program with cashback, discounts, and gift cards

- Supports loyalty card storage with Mobeam barcode scanning

Availability: Samsung Galaxy Store / Google Play Store (Free)

Best For: Samsung Galaxy device owners seeking integrated rewards

4. CommBank Tap & PayCommonwealth Bank’s native Tap & Pay solution is specifically designed for Australian consumers. It offers direct bank integration with features tailored to the local market.

Key Features:

- Direct integration with CommBank accounts—no third-party app needed

- eftpos network access for cash out when shopping with debit

- Same-day settlement for business transactions

- Payments up to $100 without PIN, unlimited with PIN

- Available on Android 4.4+ with NFC capability

Availability: CommBank App (Free)

Best For: CommBank customers wanting native banking integration

5. NAB Easy TapNAB Easy Tap is a unique solution that turns Android devices into payment terminals—perfect for small businesses. It’s also excellent for personal contactless payments.

Key Features:

- Converts Android phone into a payment terminal for merchants

- No minimum contract term and no exit fees

- Same-day settlement when processed before 9:30 PM AEST

- Secure NAB merchant-grade payment processing

Availability: Google Play Store (Free)

Best For: Small business owners and NAB customers

Best NFC Payment Apps in India (2025)

India’s fintech revolution has positioned it as a global leader in digital payments. UPI (Unified Payments Interface) processed over 640 million transactions daily in 2025, surpassing Visa in digital payments according to the International Monetary Fund. Payment giants like Google Pay, PhonePe, and Paytm are now investing heavily in NFC functionality, combining UPI convenience with tap-to-pay technology.

1. PhonePePhonePe is India’s first and largest UPI payment platform, holding approximately 37.3% market share in UPI transaction volume. It offers seamless NFC support combined with UPI, QR codes, and wallet payments.

Key Features:

- NFC tap-to-pay combined with UPI transfers

- SmartSpeaker for merchant payments with audio confirmation

- UPI Lite for faster micro-transactions

- Bill payments, mobile recharges, and investment options

- International payments in UAE, Singapore, Mauritius, Nepal, and Bhutan

- Frequent cashback offers and merchant discounts

Availability: Google Play Store / App Store (Free)

Best For: Indian users seeking comprehensive UPI + NFC payment solution

2. Google Pay (GPay India)Google Pay (formerly Tez) holds approximately 37% market share in India with over 67 million users. It was the first to introduce NFC technology in India and offers excellent integration with the Google ecosystem.

Key Features:

- Offline NFC payments via Tap to Pay feature

- UPI Lite for faster micro-transactions without PIN

- Multi-bank account linking

- IRCTC train ticket booking and 24K digital gold investment

- Google Pay Safe Shield security feature

- Supports 8 Indian languages

- Scratch cards and rewards for transactions

Availability: Google Play Store / App Store (Free)

Best For: Users wanting Google ecosystem integration with NFC + UPI

3. PaytmPaytm was the foremost digital payment service in India and remains the largest digital wallet provider with approximately 5.93% UPI market share. It dominates the QR code-based offline transaction market.

Key Features:

- NFC tap-to-pay with UPI Lite integration

- UPI Lite crossed 4.3 million users with 10 million transactions

- Wallet + UPI combined in one platform

- Paytm Soundbox for merchant audio confirmations

- Bill payments, recharges, ticket booking, and e-commerce

- Paytm Postpaid (Buy Now Pay Later option)

Availability: Google Play Store / App Store (Free)

Best For: Users who prefer wallet + UPI flexibility with wide merchant acceptance

4. BHIM (Bharat Interface for Money)BHIM is the official UPI app developed by NPCI (National Payments Corporation of India). It’s designed for simplicity and reliability, making it ideal for users who prefer no-frills banking.

Key Features:

- Government-backed UPI app with high reliability

- One-Tap UPI feature for NFC payments

- UPI Lite X for offline NFC transactions up to ₹500

- Simple interface focused on bank-to-bank transfers

- QR code scanning and payment

Availability: Google Play Store / App Store (Free)

Best For: Users preferring government-backed, simple payment solution

5. Amazon PayAmazon Pay ranks 8th in UPI market share with about 0.6% as of early 2025. It excels for users within the Amazon ecosystem with frequent cashback on Amazon purchases.

Key Features:

- UPI, wallet, and card transaction support

- NFC-enabled payments at select merchants

- Amazon Pay Later (BNPL option)

- Integration with BookMyShow and IRCTC

- Exclusive cashback on Amazon orders

Availability: Amazon App / Google Play Store / App Store (Free)

Best For: Frequent Amazon shoppers and Prime members

NFC Payment Apps Comparison Table

The following comparison table helps you quickly evaluate the best NFC payment app for your needs in Australia and India:

| App Name | Region | Platform | NFC | Rewards | Best For |

|---|---|---|---|---|---|

| Google Pay | Global | Android | Yes | Moderate | Universal use |

| Apple Pay | Global | iOS | Yes | Card-based | iPhone users |

| Samsung Pay | Global | Samsung | Yes | Strong | Galaxy devices |

| PhonePe | India | Both | Yes | Excellent | UPI + NFC |

| Paytm | India | Both | Yes | Excellent | Wallet + UPI |

| CommBank | Australia | Android | Yes | Banking | CBA customers |

How to Set Up NFC Payment Apps (Step-by-Step)

Step 1: Enable NFC on Your DeviceFor Android:

- 1. Go to Settings > Connected Devices > Connection Preferences > NFC

- 2. Toggle NFC to ‘On’

- 3. Enable ‘Contactless Payments’ or ‘Tap & Pay’ in payment settings

For iPhone: NFC is automatically enabled on iPhone 6 and later models. Simply open the Wallet app to get started.

Step 2: Download Your Preferred NFC AppDownload Google Pay, Samsung Pay, PhonePe, or your preferred app from the Google Play Store (Android) or App Store (iOS). Most apps are free and take less than 2 minutes to install.

Step 3: Add Your Payment Cards- 1. Open the payment app and select ‘Add Card’ or ‘+’

- 2. Scan your card using the camera or enter details manually

- 3. Verify your card via SMS OTP, email, or bank app authentication

- 4. Set up biometric authentication (fingerprint/face) for security

- 1. Look for the contactless payment symbol (wave icon) at checkout

- 2. Unlock your phone and open your payment app (or use default tap-to-pay)

- 3. Hold your phone near the terminal (within 4 cm)

- 4. Authenticate with biometrics or PIN if prompted

- 5. Wait for confirmation beep and receipt

How Secure Are NFC Payment Apps?

Security is the primary advantage of NFC payments over traditional card swipes. Here’s how these apps protect your financial data:

Key Security Features- Tokenization: Your actual card number is never shared. Instead, a unique encrypted token is generated for each transaction, making intercepted data useless to hackers.

- Biometric Authentication: Fingerprint scans, Face ID, and iris recognition ensure only you can authorize payments.

- Short-Range Communication: NFC only works within 4 cm, making remote interception virtually impossible.

- Device-Level Encryption: Data is encrypted at the device level using secure elements (Samsung Knox, Apple Secure Enclave).

- Real-Time Fraud Detection: AI-powered monitoring detects suspicious transactions instantly.

- Always keep your phone locked with a strong PIN, pattern, or biometric

- Enable transaction notifications to monitor all payments

- Download apps only from official stores (Google Play, App Store)

- Never share UPI PIN, OTP, or payment app passwords

- Report suspicious transactions immediately to your bank

- Keep your device software and payment apps updated

The Future of NFC Payments in Australia & India

The next few years will see dramatic growth in NFC adoption across both markets:

Market Projections- Global Growth: The contactless payment market is projected to reach $140.55 billion by 2029, growing at 19.2% CAGR.

- Australia: Digital wallet transaction values projected to exceed AUD 200 billion by end of 2025, with 20%+ growth from 2024.

- India: UPI already processes 640 million daily transactions. UPI Tap and Pay with NFC is rolling out rapidly through NPCI’s UPI Lite X network.

- Global Adoption: 78% of new POS terminal deployments include NFC/contactless capability in 2025.

- Wearable Payments: Smartwatches, fitness bands, and IoT devices will support NFC payments without needing phones.

- Public Transport Integration: Victoria, Australia launching contactless payments on public transport. Indian metros in Mumbai and Bengaluru already support tap-to-pay.

- Offline NFC: UPI Lite X enables offline NFC payments up to ₹500 per transaction (₹2,000 daily limit) in India.

- Biometric Evolution: NPCI exploring fingerprint-based UPI authentication on Android and Face ID on iPhones.

- Cross-Border UPI: PhonePe extended UPI support to UAE, Singapore, Mauritius, Nepal, and Bhutan for international payments.

Frequently Asked Questions (FAQs)

For Android users, Google Pay is the best choice due to universal bank support and wide merchant acceptance. iPhone users should use Apple Pay, which comes pre-installed. Samsung Galaxy owners benefit from Samsung Pay’s rewards program. CommBank and NAB customers may prefer their native banking apps.

PhonePe and Google Pay are the top choices, holding approximately 37% market share each. PhonePe excels with UPI + NFC integration and frequent cashback. Google Pay offers the cleanest interface and Google ecosystem integration. Paytm is ideal if you prefer wallet + UPI flexibility.

Yes, limited offline NFC payments are possible. In India, UPI Lite X enables offline transactions up to ₹500 per transaction with a ₹2,000 daily limit. In Australia, small transactions (under $100) may process offline, but internet is typically required for authentication.

Yes, NFC payments are safer than traditional card swipes. They use tokenization (replacing card numbers with encrypted codes), biometric authentication, and short-range communication (4 cm) that makes remote interception virtually impossible. 81% of consumers report feeling safer using contactless payments.

Limits vary by region and app. In Australia, transactions up to $100 typically don’t require PIN; larger amounts need authentication. In India, UPI Lite transactions are capped at ₹500 per transaction (₹2,000 daily), while regular UPI allows up to ₹1 lakh per transaction.

NFC payments are accepted wherever you see the contactless payment symbol (wave icon). This includes supermarkets, retail stores, cafes, restaurants, public transport, vending machines, and online platforms. In 2025, 78% of new POS terminals globally support NFC.

Most smartphones manufactured after 2015 include NFC. Check Settings > Connected Devices > Connection Preferences > NFC (Android) or consult your device specifications. All iPhones from iPhone 6 onwards support NFC payments through Apple Pay.

Conclusion

NFC payment apps have transformed the way consumers in Australia and India handle transactions. From Google Pay and Apple Pay’s global dominance to PhonePe and Paytm’s UPI-powered local solutions, these apps offer unmatched convenience, security, and rewards.

With the contactless payment market projected to exceed $140 billion by 2029 and adoption rates soaring across both regions, now is the perfect time to embrace tap-to-pay technology. Whether you’re an Android user in Sydney or an iPhone owner in Mumbai, there’s an NFC payment app perfectly suited to your needs.

Ready to go contactless? Download your preferred NFC payment app today and experience the future of payments—one tap at a time.

Impex Infotech specializes in custom mobile app development with NFC integration. Contact our team to discuss your fintech project requirements.

About Impex Infotech

Impex Infotech is a leading mobile app development company specializing in fintech solutions, NFC payment integration, and digital wallet development. With expertise serving clients across Australia, India, and globally, our team delivers secure, scalable payment applications tailored to your business needs.

Sources & References

- Reserve Bank of Australia – Consumer Payments Survey 2022

- Juniper Research – Contactless Payment Market Report 2025

- NPCI (National Payments Corporation of India) – UPI Statistics 2025

- Australian Banking Association – Mobile Wallet Payments Report 2024

- GlobalData – Australia Cards and Payments Market Analysis 2025

- Straits Research – Contactless Payment Market Size Report 2033

- International Monetary Fund – Digital Payments Comparison 2025

Recent Posts

WordPress Web Design Agency Australia

WordPress Web Design Agency in Australia: Expert Website Development Services Looking for a professional WordPress web design agency in Australia?...

Read MoreHow Much Does It Cost to Create an App in Australia?

How Much Does It Cost to Create an App in Australia? Table of Contents 1. App Development Cost Overview in...

Read MoreHow Much Should Web Development Cost in Australia?

How Much Should Web Development Cost in Australia? Table of Contents 1. What Is Web Development? 2. How Much Should...

Read More